By: Lori Ann LaRocco, Senior Editor of guests for CNBC Business News

Nick Vyas, Executive Director, USC Marshall Center for GSCM & Academic Director MS GSCM

Amid all the tumult unleashed by Coronavirus and the social-media turf wars, what has gone unnoticed is that the sands of the global supply-chain landscape are shifting. It began much before the present crisis, about halfway through the Sino-American trade conflict.

The trade war put pressure on multinational corporations to take manufacturing out of China. To avoid tariffs that President Trump placed on $360 billion worth of Chinese goods, companies like Samsung, Nike, Nintendo, and Williams-Sonoma moved out entirely or partially to Germany and Vietnam. The U.S. trade with China fell sharply. As a result, benefitting countries like Vietnam, Taiwan, and Mexico (Fig. 1).

Figure 1: Winners of the trade war. Source: Nomura International

In part one of this series, we looked at how Coronavirus acted as a catalyst to hasten this shift, and how these newly preferred trade destinations are experiencing growing pains while they stretch their resources to meet this opportunity.

Part two of the series looks at the critical components that global supply chain organizations need to have in place for the transition.

Engines of change

China’s manufacturing dominance was driven by providing the lowest cost of acquisition any producer could find anywhere in the world. China provided mass quantities of goods produced at the cheapest rates, at scale, consistently. All this was supported by a massive infrastructure, a relaxed regulatory atmosphere, and incentives offered to manufacturers to set up locally. This increased the world’s appetite for this cheap source of goods and influenced consumer behavior in the west.

Now, companies, hammered by the twin impact of the trade war and the pandemic, are forced to look for alternatives. In a survey done in Feb-March 2020, Gartner Inc. found out that one-third of global supply-chain organizations have either moved or plan to move their sourcing and manufacturing activities out of China in the next two to three years. And one-fourth of respondents indicated that they have already regionalized their supply chains.

This, however, comes at a cost. Companies are discovering that no other country than China can provide the same cost structure, velocity, and scale. Relocating out of China all export-related manufacturing not intended for Chinese consumption could cost firms $1 trillion over the next five years, says a new Bank of America research.

Digitalize or perish

The COVID-19 pandemic has revealed the glaring need for supply chain resiliency. The muscles supporting the Global Value Chains (GVC) were violently ripped away by the drastic imbalance of supply and demand, revealing countless fractures. The processes in the manufacturing and logistics of goods were shattered. The stability of security was gone.

The need for control is a fundamental trait that influences human behavior. The pandemic eviscerated that sense of wellbeing. Supply chain visibility became opaque as manufacturers shuttered, and vessels were canceled, while consumer demand soared.

Now on the other side of the pandemic where commerce is moving once again, we are reading more about the benefits of supply chain digitalization and the acceleration in its implementation. For the good of humanity, to achieve this, every facet that is instrumental in the flow of trade—manufacturers, logistics, carriers, ports, and warehouses—need to approach and employ these ideas and technologies with the finesse of a scalpel, not a hatchet.

The world we live in is far too interconnected to be ripped apart and started anew. Given that over 90 percent of world trade moves on water, the solution to streamlining trade lies in improving the performance metrics of intermodal logistics.

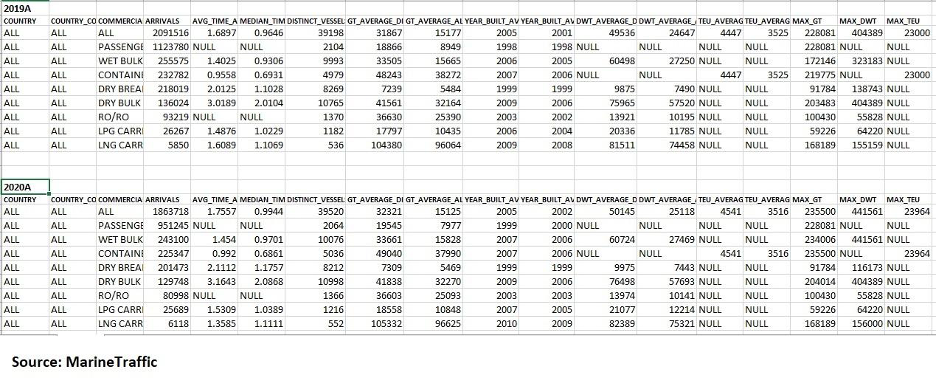

According to MarineTraffic AIS data, over 22 percent of commercial vessels arrive at their destination a day later than planned. Fifteen percent of vessels are also making additional stops in route to their destination. (Fig.2) This impacts efficiency. (Fig. 2) Commercial vessels face delays

A series of crises such as U.S. port strikes, the pandemic, and the Beirut port explosion have played havoc with the maritime logistics sector’s service reliability and increased the demand for improved visibility. “Our Forecast ETA calculations and metrics on waiting times have long been pieces of information most requested by the logistics and supply chain sectors,” said Daniel Shirley, senior product manager at MarineTraffic.

“We’re currently seeing a big rise in requests for information on both vessel whereabouts and potential delays. These inquiries are from people looking to get ahead of the game and understand the potential impact the COVID-19 pandemic will have on their supply chain. This is a spike in demand for improved shipping visibility rather than a fresh need for information.”

Removing in-transit uncertainty by monitoring a vessel’s journey end-to-end through digitalization can inject more stability and control in this new normal where manufacturing is an amalgamation of global companies.

The trouble is, the maritime industry is not ready for a digital transformation. Containerized shipping is still heavily reliant on paperwork and personal interactions, further hampered by lockdown restrictions during the pandemic. According to the World Economic Forum, 20 percent of shipping goods’ cost is administrative paperwork expenses. Even the ports are far from prepared. To illustrate, only 49 of the 174 Member States of the International Maritime Organization have functioning Port Community Systems (PCS), to date. PCS are inter-organizational software platforms that enable information exchange and are crucial to the digitalization of ports.

Digitization of paperwork will not only benefit ocean freight, but it will also help boost international trade. According to the U.N., a complete digitalization of shipping trade paperwork in the APAC region alone could raise yearly exports by $257 billion, a massive boost for regional exporters.

Sector stakeholders are, of course, acutely aware of the need for digitalization. In June 2020, several prominent industry associations jointly launched a ‘call to action’ to accelerate the digitalization of maritime trade and logistics. Co-signees included the International Association of Ports and Harbors (IAPH), BIMCO, the International Cargo Handling Coordination Association (ICHCA), the International Chamber of Shipping (ICS), the International Harbor Masters’ Association (IHMA), the International Maritime Pilots Association (IMPA), the International Port Community Systems Association (IPCSA), among others.

With the trade patterns shifting from traditional monolithic supply chains to near-shored, decoupled trade networks, companies need to be willing to embrace automation and digitalization to survive.

Another example of the interdependence of value chains is the assembly of automobiles. The U.S. automobile constitutes so many foreign parts; the American Automobile Labeling Act of 1992 mandates that only 55 percent of all car components need to be made in America to be labeled “American Made.”

According to Cars.com American-Made Index, the Ford Ranger is the number one most American made vehicle in 2020 with 70 percent domestic parts. For this reason, digitalization is needed, so the sum of all product segments can be efficiently produced, tracked, and transported. This can feed the sense of control humanity is so desperately seeking. Unfortunately, you have parts of the world that are still pushing paper because of the digital disparity. Therefore precision, like a trained surgeon using a scalpel, is needed when constructing a proper digital supply chain that is interoperable. Building various platforms that cannot talk to each other, leaving critical components out of such communication, uses the equivalent of a hatchet to make a delicate incision.

Visibility/transparency saves lives

A real-world example of digitalization deployment is the timeline of personal protective equipment (PPE) being sourced and transported to the state of Minnesota during the pandemic.

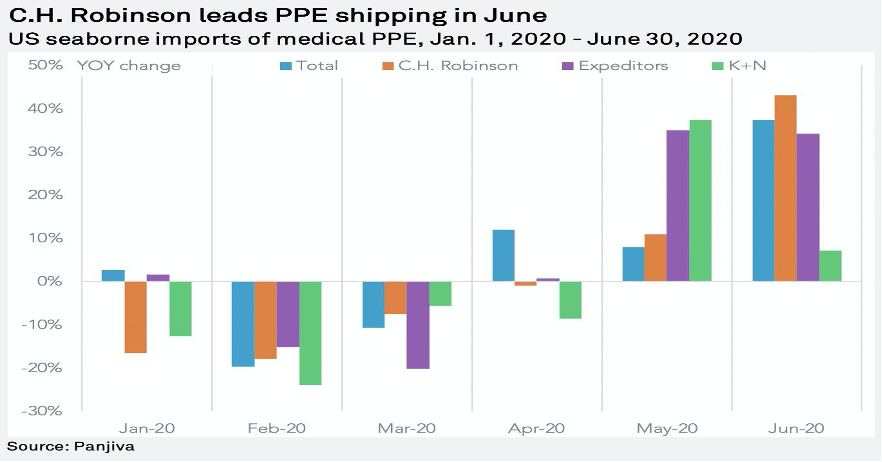

The timeline began in mid-March when Governor Tim Walz created an economic council with partnerships from both the public and private sectors. The mission: secure the badly needed PPE as quickly as possible. C.H. Robinson was one of the companies asked to help (Figure 3).

The PPE procurement not only involved the fulfillment in the immediate surge in demand, but the significant competition amongst other states and federal agencies all vying for the same product, inbound quality checks to vet out fakes and bad quality PPE, which added time to the delivery of the product, medical protectionism, as well as keeping up with changes in U.S. Customs and Chinese regulations.

“We originally reached out to our contacts and resources in Wuhan, China, to help locate new suppliers for the state,”explained Mac Pinkerton, C.H. Robinson’s North American Surface Transportation division. “While we were successful in moving product out of China, we also provided additional routes. Digitalization enabled us to quickly identify the bottlenecks in the supply chain and identify other areas of opportunity.”

One example of such an opportunity was the decision to use the ‘fast boat’ over air freight to deliver an order of surgical gowns. In times of crisis, real-time visibility is vital.

Figure 3:

“As the number 1 NVOCC from China to the United States, we have insights into a range of shipments in Asia, including those from less sophisticated manufacturers who might still rely on paper and phone calls,” explained Mike Neill, chief technology officer at C.H. Robinson.

Mac Pinkerton, President, North American Surface Transportation, C.H. Robinson, added, “The past six months have reinforced how we invest in technology to continue to solve the real problems facing companies and, with our tech capabilities, we’ve been able to empower our people, and in turn our customers, to make smart decisions throughout the crisis. We have been able to build supply chain resiliency for our customers, which has always been thought of as important but has never been tested like it was this year.” Over 72 million pieces of PPE were procured.

Interoperability equals less siloed friction resulting in success

The success of an efficient supply chain relies on the relationships of all those involved within a supply chain. A deep understanding of all participants’ strengths and weaknesses is needed, so the flow of trade can move as efficiently and cost-effectively as possible. This provides an opportunity for other parts of the supply chain to lean in. “We have pockets around the world in inner China, Asia, and Eastern Europe, where they are not digital at all and are still pushing paper. They lack the digital technology to be efficient,” explained Pinkerton.

“This is where companies like CH Robinson are stepping in to be an equalizer,” added Neill. “There is a play for intermediaries to help less sophisticated manufacturers interact with companies that are digital and meet their supply chain. Digitalization is enhancing the human element by using that digital connection to allow people to work together and solve problems.”

Interoperability in the technology base is also necessary. Every leg of the supply chain needs to have the ability to be tracked in real-time. The relationships and trust between the participants are paramount. If not done correctly with scalpel accuracy, personalization and isolation can result. The development of such digital infrastructure takes time. An example of deep cooperation between the public and private sectors is the Port of Los Angeles.

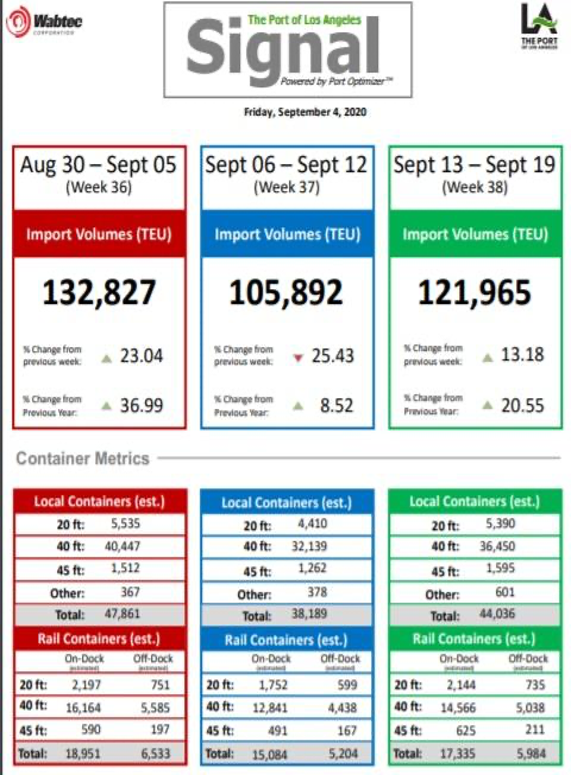

The Port of Los Angeles recently released its digitalization offering, Signal, which offers its users a three-week look at cargo arriving into the port (Figure 4). The information broken down by the type of container, volume of shipments, and method of transportation gives users the ability to plan.

Figure 4:

“Digitalizing the supply chain takes people,” explained Gene Seroka, Executive Director of the Port of Los Angeles, and Chief Logistics Officer of the City of Los Angeles. “We initially started with roundtable discussions five years ago. Data sharing agreements, standards of best practices–all of this is necessary to achieve the goal in supply chain visibility and security.”

Knowing if the container is being transported on a dock or off dock gives truckers, railroads, and chassis providers the visibility to prepare for the incoming volumes. Because of the fragmented nature of the supply chain and its dynamic breath, digitalization creates a community within the chain.

“Technology is the only way to bring the many stakeholders together to move cargo efficiently and transparently,” explained Weston LaBar, CEO of the Harbor Trucking Association. “The adoption of the carrier alliances, coupled with eCommerce demand, requires better planning and the ability to be more adaptive in real-time.”

Unlike a neat, precise cut of a scalpel, the strike of a hatchet, while it can be controlled, is still deep, jagged, and wide. If done correctly, digitalization is precise. If not, the result is gaping voids of inefficiency with countless “best in breed” technologies and existing digital platforms already in use. The democratization of supply-chain technology and visibility would help better meet consumer demand. “There are too many antiquated legacy systems that can’t properly handle the volume of data being generated,” said LaBar. “We have also seen pushback from stakeholders who have already invested in systems and don’t want to be forced to conform to new standards. Finally, there are some companies that profit off the inefficiencies in the system. They don’t want that brought to light by transparency.”

With supply chain digitalization in the United States still in the early innings, Seroka hopes Signal could be the catalyst to start a discussion on a single standardized digital data set for the country. This is not a pie in the sky concept.

In 2014, the Port Call Optimization Taskforce was created out of the Port of Rotterdam with the sole purpose of encouraging the creation of a single standardized digital dataset. Implementing the same ISO standards used in both the maritime and logistics sectors would create greater efficiency, predictability, and a tighter turnaround of goods being offloaded at the port. The digital black holes of inefficiencies would collapse.

“Even if our eight to 12 participants each gain one percent efficiency, that’s a total gain of 8-12 percent,”explained Seroka. “This is just the beginning. Imagine if we had a nationwide port community system? Digitalization would provide visibility for its users and competitiveness for the nation’s ports. Unfortunately, what stops this implementation is personality and politics.”

The new supply chains

The lean inventory of the manufacturing sector associated with the modern ways of supply-chain management is not working in a pandemic age. The numerous stories on the shortage of Bounty paper towels and other products could fill the empty shelves at retailers worldwide.

“Companies around the world have all tried to run lean, efficient, and keeping inventory levels light,” explained Neill. “Unfortunately, the world has learned this just in time inventory is not going to work if we need to plan for supply chain disruptions. All companies are now looking at what are the right inventory levels to strike a balance.”

This change in consumer behavior for essential items shows no stop in slowing down. At the Port of Los Angeles, cleaning product imports were up 256 percent from January to August.

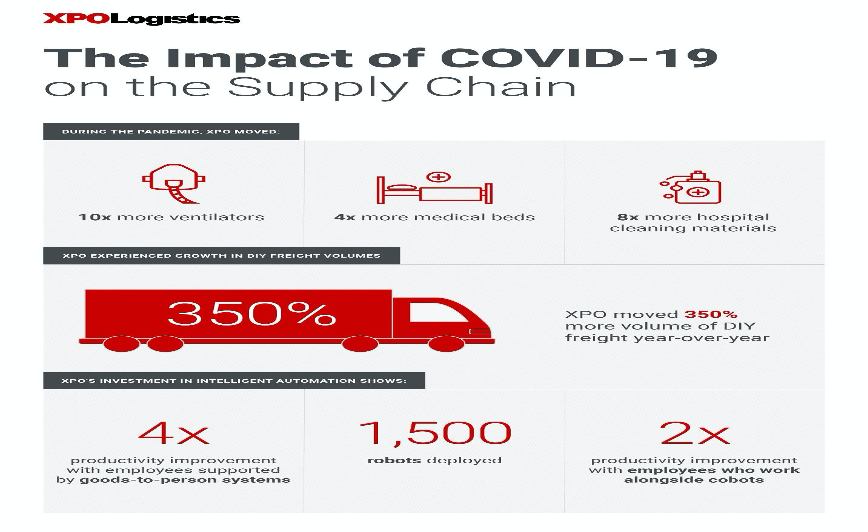

“For the longest time, we have designed our supply chains for responsiveness and how you would fill that demand,” explained Ashfaque Chowdhury, President of Supply Chain, Americas, and the Asia Pacific at XPO Logistics. “Now we have to reimagine the supply chain, so it’s not only resilient but sustainable. The right levels of inventory need to have a balance.”

This graphic from XPO tells the COVID supply chain tale:

Figure 5:

Home office products have also been coming into the United States as more Americans are working from home. Volumes for home office freight doubled in May for XPO year over year.

The Key to optimizing infrastructure and utilization

In addition to data sharing environments, upgrading processes, and the potential in using predictive data to make those smart decisions, there is one critical piece to this digital puzzle: people. “We have a facility in Wuhan, so we knew the seriousness of the disease might be ahead of other companies,” explained Chowdhury. “In mid- February, we convened our business continuity team on best practices. Our pandemic business approach was very similar to how we plan for storms. XPO has spent $49 million in COVID measures in Q2 2020 alone. Logistics is an important business. For trade to move, you need to make sure the people within the supply chain are safe. We have a team that is dedicated to this. But most importantly, you need to make sure your employees are engaged.”

Across the trade spectrum, digitalization will influence how each facet of the supply chain will impact both society and the environment. Benefits include enhanced trade relations, efficient energy use, waste emissions, services, and labor.

“Digitalization means a shift to more knowledge economy-oriented labor,” explained Ian Bremmer, president and founder of the Eurasia Group. “The cost differential that made global supply chains so attractive accordingly becomes less important. That’s an advantage for consumer markets and countries with the most highly skilled workers. Add to that protectionist impulses coming from higher unemployment rates, and you’re going to see significant shrinking [of human capital] in the supply chain in manufacturing and services.”

Advances in technology, such as those involved in digital transformation, have a history of inflicting pain and distress in the form of technological unemployment. A Keynesian phrase, technological unemployment means a loss of jobs caused by automation.

The fourth industrial revolution is as big a displacer of jobs, if not more significant.

A Mckinsey report found that automation could displace 15 percent of the global workforce, about 400 million workers, by 2030. At the fastest rate of automation, such as that seen during the pandemic, that figure could rise to 30 percent of the global workforce or 800 million workers.

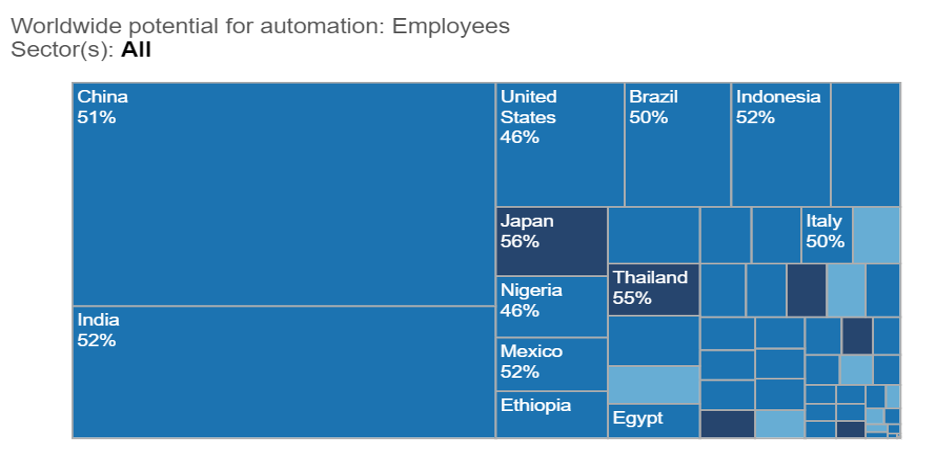

American workers will be among the worst affected countries in such a scenario. The automation potential i.e., the percentage of jobs that could be replaced by automation for the US, is a disquieting 46 percent, representing 60.6 million employees (Figure 6). Retail trade, manufacturing, and transportation and warehousing jobs are the most susceptible of all sectors. In transportation and warehousing, close to 60 percent of jobs are automatable, implying a job displacement for 3 million workers (by 2017 figures).

Figure 6: Impact of automation on jobs

Source: Global Mckinsey Institute

Technological unemployment caused due to digital transformation, of which automation is an integral feature, will not be restricted to blue-collar workers i.e., factory and warehouse workers, truck drivers, and construction workers. It will impact jobs across the spectrum, especially white-collar professionals whose work involves data processing and collection.

The first industrial revolution replaced agricultural occupations and increased urbanization on a large scale, which, in an unprepared world, spawned absolutist ideologies that destabilized whole populations and economies.

That need not be the case for the fourth industrial revolution. Today, many ameliorating strategies are available to corporations and governments, and some of these measures have been implemented with demonstrable success. Denmark’s “flexicurity” (a portmanteau of flexibility and security) solves two most significant challenges at once. It helps employers deal with disruptions like the pandemic by giving them a free hand to reconfigure the workforce. At the same time, it provides generous unemployment benefits and retraining opportunities to workers to help with the transition.

It has been demonstrated that even in the developing countries that policies supporting and cushioning labor mobility reduce poverty and increase the participation of women in the workforce.

In the end, no matter how compelling the data is in support of digital supply chains, the successful evolution of Global Value Chains hinges on mankind, and the willingness to work together. If not, we will end up with numerous “best of breed” technologies that are only “best” in their tiny cyber universe. The tech isolations will result in incomplete information, just like in the child’s game of telephone.

As exciting as the supply chains of the post-COVID world look from where we stand, we must approach it with a sense of cautious optimism. Digitalization will impact the developed world and the developing world with an equal force. While the developed world has evolved through its share of crises and disruptions to create safety nets like social security, universal healthcare, and wage insurance, the developing world, which comprises 80 percent of the world’s population, is mostly unprepared the change.

Authors:

Lori Ann LaRocco is senior editor of guests for CNBC business news. She coordinates high profile political, titans of industry interviews and special multi-million dollar on-location productions for all shows on the network. LaRocco is a maritime trade columnist for American Shipper, the author of: “Trade War: Containers Don’t Lie, Navigating the Bluster” (Marine Money Inc., 2019) “Dynasties of the Sea: The Untold Stories of the Postwar Shipping Pioneers” (Marine Money Inc., 2018), “Opportunity Knocking” (Agate Publishing, 2014), “Dynasties of the Sea: The Ships and Entrepreneurs Who Ushered in the Era of Free Trade” (Marine Money, 2012), and “Thriving in the New Economy: Lessons from Today’s Top Business Minds” (Wiley, 2010).

Prior to joining CNBC in 2000, LaRocco was an anchor, reporter and assignment editor in various local news markets around the United States.

EDUCATOR. KEYNOTE SPEAKER. AUTHOR. GSCM SPECIALIST. INDUSTRY ADVISOR. THOUGHT LEADER

Dr. Nick Vyas is an educator, thought leader, author, keynote speaker, ASQ Fellow, Chair of the ASQ Lean Division, and advisor to leaders in the worlds of supply-chain practice and policy. As the Executive Director and founder of Center for Global Supply Chain Management (CGSCM), and Academic Director, USC Marshall MS GSCM program, Vyas educates the next generation of business leaders.

An early proponent of the need to recognize the pivotal role of global supply chain management in international trade policy trends and economic growth, Dr. Vyas has frequently contributed articles and opinion to reputed media platforms such as Supply Chain Management Review (SCMR), NPR, KCRW, CBS News, The Economist, Los Angeles Times, Rachel Maddow Show, and the LA Business Journal. He is the co-author of Blockchain and the Supply Chain: Concepts, Strategies and Practical Applications, a book that highlights industry use cases to illustrate the significance of blockchain as an enabler and a key driver for solutions in global supply chain networks.

As a recognized thought leader, Vyas delivers keynote addresses at conferences held across the globe, particularly in countries home to economies in transition such as Brazil, China, India, Mexico, Singapore, and the Dominican Republic, on matters concerning global trade, disruptive technologies and their impact on global supply chain management and operations.

An authority on global SCM and Logistics, Vyas has led business and cultural transformation for Fortune 100 M&A Companies over the last 30 years. He also serves as a member of the U.S. Department of Commerce Advisory Committee on Supply Chain Competitiveness.

He has received his Doctor of Education from the USC, with a published dissertation on Conceptualization of Higher Education Excellence System (HEES): Use of Advance Data Analytics and Blended Quality Management.

Currently, Dr. Vyas is working with other experts and universities on a supply chain healthcare consortium initiative to: create and provide aggregate demand forecast for running 12 weeks for the hospital inventory model; secure/aggregate demand allocation by city/state to create cooperative procurement opportunities; help guide our local hospital network through supply chain issues, including logistics, distribution and last-mile deliveries; create a network of alliances at the Local/State level to facilitate synchronized execution.