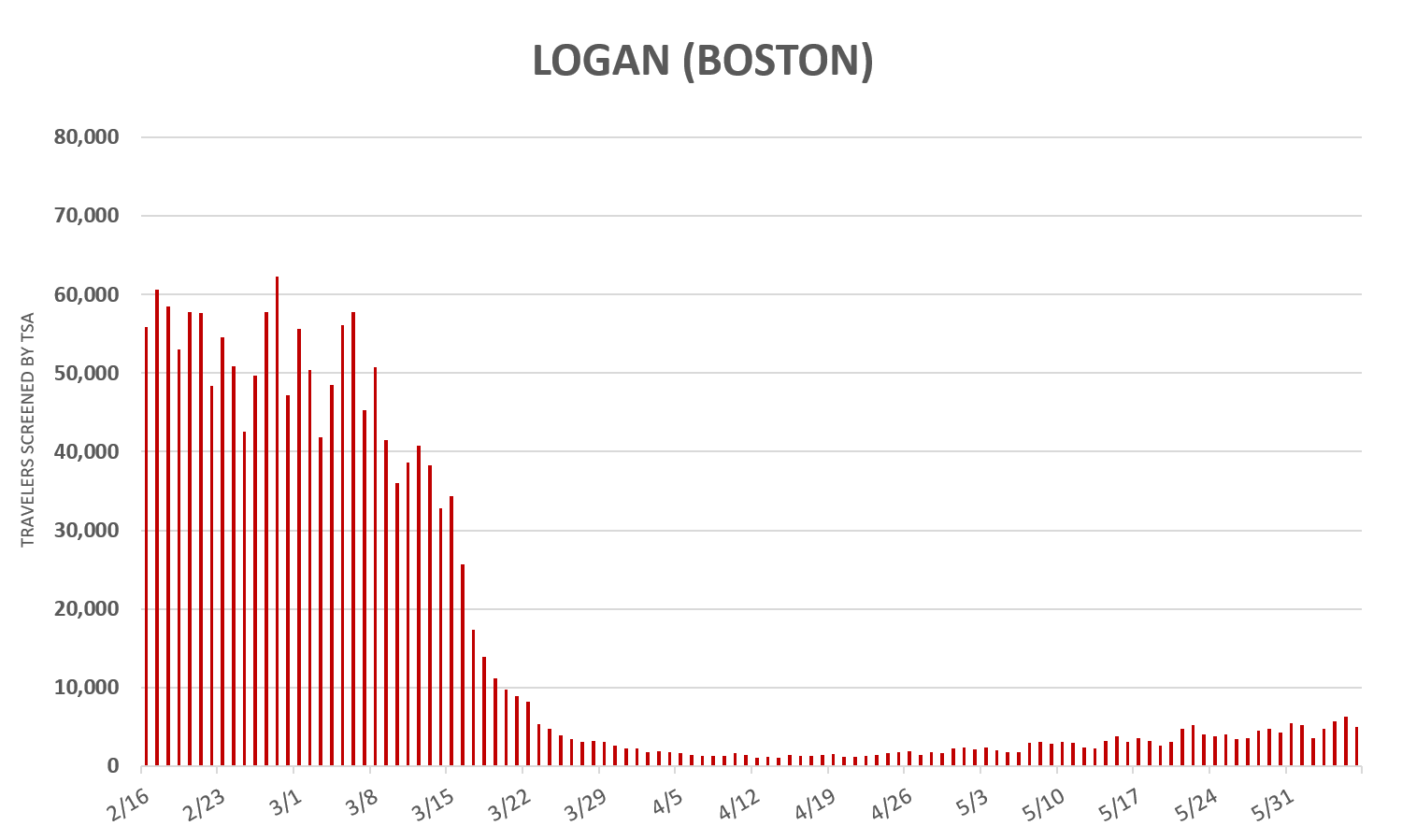

The pattern is pretty much the same across airports in the United States: Air travel nosedived in March in response to the coronavirus pandemic and passenger volumes hit rock bottom in mid-April. Since then, more travelers are taking to the skies, but an updated analysis of data from the Transportation Security Administration by APM Research Lab shows that, across the nation’s 20 busiest airports, the number of travelers being screened for outgoing flights remains at eye-popping lows.

Over the Memorial Day weekend, for example, the average number of passengers that passed security checkpoints at most of those busiest airports was less than 20% what it was February. At four of those airports—San Francisco International, Newark Liberty, Logan International in Boston and John F. Kennedy in New York—the outgoing traffic was less than 10% what it had been in February.

“We’re seeing an unprecedented shock to air travel, not even matched by what we saw after 9/11 and the Great Recession combined,” Paulos Lakew, director of airport finance and economics at Unison Consulting, said.

Air traffic ground to a halt in the spring because of three factors: travel restrictions, social distancing and people simply not wanting to fly. Because those three factors cut so widely, it’s unsurprising that many airports across the U.S. followed the same basic trend line, Lakew said.

However, the nationwide lockdown and the public’s newfound fear of flying only account for part of the slow recovery. The sudden upheaval has also changed the reasons that travelers—particularly those traveling on business—have for getting on a plane.

“For last three, four months, what we’re seeing is that we continue to function in some limited capacity without actually physically traveling,” Nick Vyas, a professor of global supply chain at the University of Southern California’s Marshall School of Business, said. “We’re getting used to adopting virtually working.”

The key paradigm shift for businesses, particularly multinational groups and others that previously relied heavily on in-person meetings, will be reclassifying essential and nonessential trips, Vyas said.

“Approximately 70% of the travel that would have been labeled essential before COVID can now be reclassified as a non essential,” he said. “That is a huge number.”

Vyas gave a personal example: He said that USC and several other universities have canceled faculty business trips for the rest of 2020.

A report published by the U.S. Bureau of Transportation Statistics in 2005 concluded that it took almost three years for passenger volumes to recover after the September 11 terrorist attacks. Paulos Lakew noted with some optimism that in the current landscape, passenger volumes nationwide have already rebounded to 25%, just three months after lockdown measures became widespread across the U.S.

Lakew also noted the rate of change for screenings, week over week, at particular airports. In the month of May, for example, Orlando, Denver and Las Vegas led the pack for processing more travelers each week. Those increases mirror the lifting of stay-at-home orders in Florida and the reopening of casinos in Las Vegas.

“However, because of the current rise in COVID-19 cases and hospitalizations in the country, it’s likely that the recovery of U.S. airport traffic will continue being relatively slow,” he said.

Curious to see how your local airport has fared during the pandemic? Use the tool below to select any airport in the U.S. and visualize the data.